Global Trends in Recycled Polyester Usage Across Apparel, Bags, and Industrial Applications

Recycled polyester (rPET) has shifted from niche to mainstream over the last five years. While its share of total polyester has wobbled due to surging virgin output and bottle-feedstock constraints, absolute rPET volumes, investment, and brand adoption have all grown.

What’s driving that growth? A cocktail of sustainability commitments, tightening regulation, rising consumer expectations, and rapid innovation in both mechanical and chemical recycling.

Below is a data-driven view of where rPET is today and where it’s headed across apparel, bags, and industrial/technical applications.

The big picture: growth, but an uneven share story

From 2020 to 2023, global rPET tonnage grew modestly, yet its percentage of total polyester slipped as cheap virgin capacity flooded the market.

Despite that, rPET’s market value expanded (helped by brand demand and product premiums), and the pipeline of new recycling facilities suggests stronger momentum toward 2025.

In parallel, industry pledges like the recycled polyester challenge set ambitious targets that, while unlikely to be fully met by 2025, catalyzed investment and procurement shifts across the supply chain.

What this means: rPET’s penetration rate is not a perfect proxy for progress; watch capacity additions, long-term brand contracts, and regulatory tailwinds to gauge true trajectory.

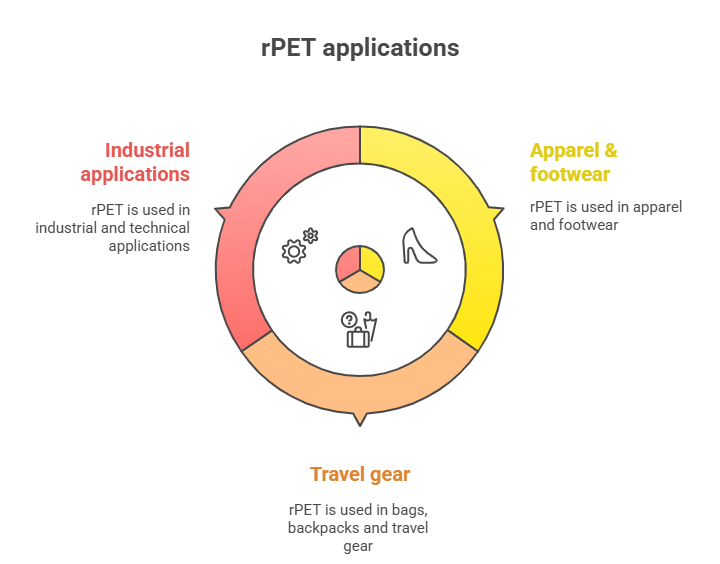

Segment deep-dive: where rPET is used (and growing)

1) Apparel & footwear: still the demand engine

Apparel is the largest user of recycled polyester by far, accounting for a substantial share of global rPET demand thanks to T-shirts, fleece, activewear, swimwear, and performance outerwear. Major brands have integrated rPET into core lines, with sportswear and outdoor leaders raising the bar on recycled content across jerseys, leggings, and shells.

As consumer awareness of material choices grows, rPET garments command credible sustainability narratives (and sometimes modest price premiums) without sacrificing performance, such as moisture-wicking, durability, and colorfastness.

Why it’s growing:

- Brand-level targets to phase down virgin polyester.

- Proven parity with virgin polyester in many apparel constructions.

- Stronger consumer preference for recycled inputs, especially among Gen Z and Millennials.

Outlook: Expect steady volume and value growth through 2025 as category penetration widens beyond hero products (fleece, tees) into linings, interlinings, trims, and circular capsule collections.

2) Bags, backpacks, and travel gear: small share, fast growth

While bags and luggage consume a smaller overall tonnage than apparel, the segment is expanding quickly. From daypacks and totes to premium luggage, brands highlight “bottles saved” and recycled linings (e.g., rPET interiors) to differentiate and meet corporate sustainability KPIs.

As the durability and abrasion resistance of rPET fabrics have improved, recycled options now meet demanding performance specs for travel and outdoor use.

Why it’s growing:

- Clear, consumer-friendly storytelling (e.g., “this backpack = X bottles”).

- Procurement standards from retailers and enterprise buyers.

- Migration of recycled textiles from “eco niche” to mainstream collections.

Outlook: Expect sharp value growth (even if weight share stays modest) as major luggage lines and specialty carry brands standardize recycled linings and shells.

3) Industrial & technical applications: the quiet heavyweight

Beyond fashion and bags, rPET has become ubiquitous across home textiles, automotive, construction/geotextiles, insulation/fiberfill, nonwovens for hygiene, and filtration.

Many of these products are fiber-intensive, which makes technical segments collectively account for a large slice of rPET volume.

- Home textiles (upholstery, carpets, bedding, curtains): Steady adoption as mills and retailers pivot to recycled staple and filament without compromising hand-feel or durability. Hospitality and contract markets add pull via sustainability specs.

- Automotive & transport interiors: Seat fabrics, headliners, carpeting, door trims, especially in EVs and premium models, are incorporating rPET to improve lifecycle scores. Innovation in high-tenacity yarns and blends is expanding what’s possible.

- Construction & geotextiles: Soil stabilization fabrics, insulation boards, roofing felts, and reinforcement fibers benefit from rPET’s strength-to-weight and cost-effectiveness, plus green-building credits (e.g., LEED).

- Hygiene/nonwovens: Diapers and wipes leverage rPET in blends for strength and absorbency, with volumes growing off the back of massive category scale.

Outlook: Expect continued, diversified growth as procurement policies and eco-labels favor recycled inputs and as chemical recycling unlocks more “hard-to-recycle” feedstocks for high-spec uses.

What’s powering demand: environment, policy, and people

Environmental advantage: lower carbon, less waste

Against virgin polyester, mechanically recycled PET can cut emissions dramatically, making it a fast, scalable lever for fashion and textile climate targets. The “waste diversion” story (from bottles to fabric) resonates with both brands and buyers and dovetails with circular-economy principles.

Policy tailwinds: mandates and circularity frameworks

Even when regulations don’t target textiles directly, recycled content mandates for PET bottles in the EU and California have increased rPET demand system-wide.

The EU’s strategy for sustainable, circular textiles foreshadows future eco-design and EPR policies (collection, sorting, recycling), nudging brands to increase recycled content now to stay ahead of compliance.

The flip side: stronger bottle demand tightens fiber feedstock, pressuring prices and availability, one reason rPET’s market share plateaued in 2022–23.

Consumer preference: sustainability is now table stakes

Surveys show buyers increasingly value sustainable materials and will often pay a modest premium for them. Transparency expectations are also higher: certifications (e.g., GRS) and credible claims matter to avoid greenwashing.

Result: recycled-content labeling has moved from a marketing flourish to a purchase driver across apparel, bags, home, and even auto interiors.

Supply-side unlocks: innovation across recycling technologies

Mechanical recycling gets bigger and better

AI-enabled sorting, improved washing, and compounding (chain extenders, stabilizers) are raising flake quality and expanding use cases.

Global capacity additions (2023–2025) increase throughput and help close regional gaps created by shifting waste-trade policies.

Chemical recycling (molecular recycling) moves to scale

- Methanolysis and glycolysis plants can depolymerize PET back to monomers, enabling virgin-equivalent resin from mixed, colored, or textile feedstocks that are hard to handle mechanically.

- Enzymatic recycling (e.g., emerging European projects) promises to process blended or colored materials at lower temperatures with high purity.

- Early commercial deployments expected by 2025 create on-ramps for textile-to-textile circularity and expand feedstock beyond bottles into post-consumer garments, thermoforms, films, and industrial waste.

Why it matters: Chemical recycling won’t displace mechanical recycling for bottle-to-fiber, but it unlocks new feedstock pools (especially apparel waste) and high-spec applications, reducing dependency on limited bottle flows.

Supply chain & brand ecosystem: who’s scaling rPET

A mix of global resin/fiber majors, specialized recyclers, and brand coalitions underpins the rPET surge. Integrated players collect bottles, produce flakes, spin yarns, and certify traceability (e.g., GRS).

Brands across sportswear, outdoor, fast fashion, travel goods, and home channels have embedded rPET into assortments, with public targets that create long-term offtake certainty for recyclers.

Partnerships (brand–recycler–mill) are increasingly the norm for reliable quality and volumes.

Challenges to watch (and how the industry is responding)

- Feedstock competition & price volatility

Bottle mandates for packaging raise rPET resin prices and siphon supply away from fiber. Response: diversify feedstocks (textile waste, thermoforms, films) and invest upstream in collection/sorting infrastructure. - Quality & performance for specialty applications

Not all end-uses accept mechanically recycled properties; chemical recycling and advanced compounding are closing the gap for high-tenacity and safety-critical textiles. - Claims, traceability, and greenwashing risk

Expect stricter scrutiny of recycled-content claims. Scalable certification and digital product passports will reward verifiable rPET and penalize vague marketing. - Microfiber shedding

Recycled vs virgin doesn’t change shedding; innovation is shifting toward fabric construction (filament vs staple), finishes, and consumer care guidance to mitigate release.

What does this mean by category

- Apparel: Broader adoption across basics and performance categories. More capsule lines using textile-to-textile rPET as pilot scale. Merchandising will emphasize verified recycled content and carbon savings.

- Bags & travel: Recycled linings become standard; shells increasingly rPET where abrasion/tear specs allow. Expect stronger sustainability storytelling at mid- to premium price tiers.

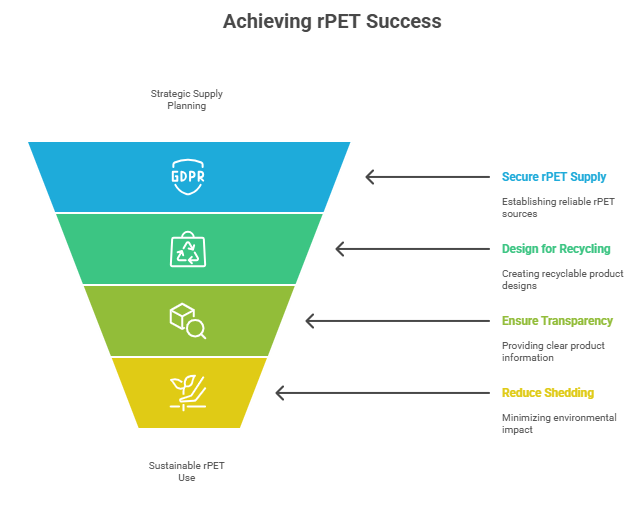

How brands and buyers can win with rPET

- Lock in supply strategically: Blend short-term mechanical rPET offtakes with multi-year MOUs for chemical-recycled inputs coming online 2024–2026. Co-invest where possible.

- Design for recycling: Prefer mono-material polyester constructions, avoid problematic coatings, and spec dope-dyed recycled yarns to reduce water/energy and simplify end-of-life.

- Prove it: Use GRS/RCS certification, share chain-of-custody data, and prepare for digital product passports. Clear, quantifiable claims convert and reduce compliance risk.

- Mitigate shedding: Favor filament constructions for high-shedding risk items, consider finishes that reduce release, and include consumer care guidance (wash-bags, lower-temp cycles).

- Tell the full story: Move beyond “bottles saved” to lifecycle impacts (CO₂e avoided, water savings), circular design choices, and take-back pilots especially powerful for B2B buyers in hospitality, automotive, and construction.

Conclusion

Despite near-term headwinds, recycled polyester is on a durable growth path across apparel, bags, and industrial applications. Mechanical recycling will continue to supply the bulk of volumes, while chemical recycling scales to unlock textile-to-textile circularity and higher-spec use-cases.

With policy tightening, consumer expectations rising, and supply chains professionalizing around verification and quality, rPET is set to move from “option” to “default” in many product categories beyond 2025.

For brands, retailers, and B2B buyers, the winners will be those who secure supply, design for circularity, and back claims with transparent data.

FAQs

1) What’s driving the rise of recycled polyester (rPET) from 2020–2025?

Brand sustainability targets, early policy moves (recycled-content rules), improving consumer preference, and better recycling tech (both mechanical and chemical) are pushing rPET into mainstream products.

2) How does rPET performance compare with virgin polyester in apparel and bags?

For most uses, tees, fleece, activewear, linings, backpacks, and rPET match virgin on durability, colorfastness, and moisture management. High-tenacity or specialty applications may require blends, additives, or chemically recycled inputs.

3) Why do prices and availability of rPET fluctuate?

Competition for bottle-grade feedstock (especially from beverage mandates) can tighten supply and lift prices. Brands mitigate this with long-term contracts, diversified feedstocks (textile waste, thermoforms), and supplier partnerships.

4) Mechanical vs chemical recycling: what’s the difference?

Mechanical recycling cleans and reprocesses PET into flakes/pellets, efficient for clear bottle streams. Chemical recycling breaks PET to monomers, creating virgin-equivalent resin and unlocking harder feedstocks (colored textiles, mixed waste).

5) Which certifications should buyers look for to verify recycled claims?

The Global Recycled Standard (GRS) and Recycled Claim Standard (RCS) provide chain-of-custody verification. Increasingly, brands pair these with batch tracking and digital product passports to prevent greenwashing.

6) Does rPET shed fewer microfibers than virgin polyester?

Shedding is influenced more by yarn type (filament vs staple), fabric construction, and finishes than by recycled vs virgin status. Choosing filament fabrics, tighter constructions, and good care guidance helps reduce release.

Contact Information

- Mon - Sat: 10:00am-7:00pm

- 4/32-33 Triveni Nagar , Meerpur Cantt , Kanpur-208004

- +91 9839708040 | +91 9936159591

- gncfabrics@gmail.com

Quick Links

- About Us

- Products

- Blog

- Contact Us

© 2024 GNC EXPORTS, All rights reserved. Developed by DIGI PEXEL

- Privacy Policy

- Terms & Conditions

- Cookies Policy